Identifying Customer Needs and Improving Product-Market Fit: A Segmentation Study

BACKGROUND

After releasing a smart workflow management tool designed to help property managers manage their maintenance workflows, the product team realized that the tool was not gaining widespread adoption as anticipated. This project was conducted to help product leaders enhance the adoption rates and minimize churn.

- My Role

-

- I was the principal investigator for this study and was responsible for all aspects of study design, data collection, analysis, and share-out.

- Stakeholders

-

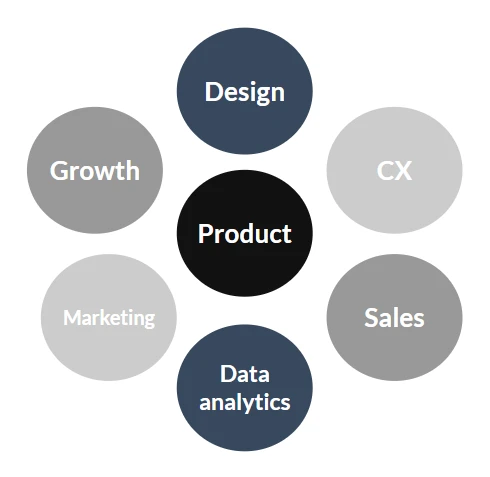

- My main stakeholders were product leaders, but I also worked very closely with design, data analytics, CX, marketing, sales, and growth.

- The Problem

-

- In order to gain a deeper understanding of the problem space, I conducted stakeholder interviews and reviewed past research (i.e., desk research).

-

- I discovered that while we had valuable qualitative research on customer profiles and pain points, we lacked information on the prevalence and importance of these pain points among our target customers. This is crucial because, to achieve high adoption rates, we have to prioritize the problems that affect the largest number of customers. Furthermore, to expand our user base, it is essential to identify potential customer segments and determine which additional problems we should address to meet their specific needs.

-

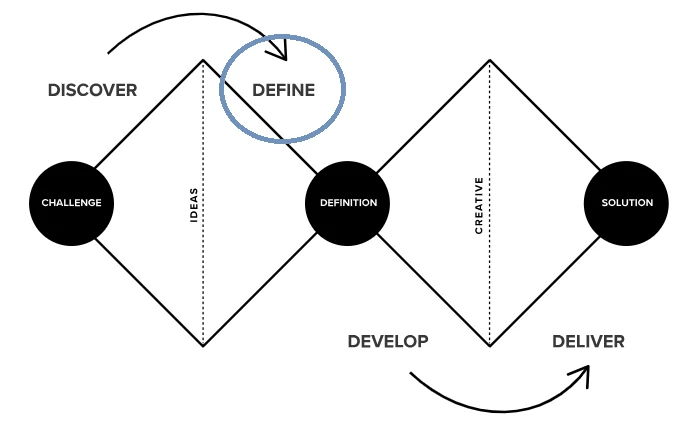

- Why is it important to ensure that we are solving the right user problems? According to the Double Diamond model, the path to successful product development begins with the 'Discover' and 'Define' phases, which are dedicated to understanding and pinpointing the most pressing user problems to address. Neglecting these two phases can result in products that fail to meet users’ needs, ultimately leading to low adoption rates.

-

- At that point in the project, we were in the 'Define' phase because we were trying to determine if we were solving the right problems for our customers and, if not, which problems we should be addressing.

- Research Questions

-

-

What user and non-user segments can we identify based on key variables, such as firmographics, unmet needs, and business goals?

- a. What are the sizes of these segments?

- b. What percentage of our customer base (both users and non-users) actually encounters the problems we aim to address with our product?

- c. How do the goals and needs of our customer base vary between segments?

- d. How do users and non-users differ in terms of firmographics, unmet needs, and business goals?

- What is the product-market fit for each segment?

- a. For segments with poor product-market fit, what can be done to improve it?

-

- Timeline

-

- 2.5 months

- Deliverables

-

- My deliverables included user personas representing different segments and a list of recommendations to enhance the product-market fit for key segments.

METHODS

- Using the information gleaned from my desk research and internal expert interviews, I generated a list of hypotheses and identified key variables to segment my data. From the list of variables, I selected the ones that could be extracted from the company’s internal data warehouse (analytics) and measured the rest through a survey.

- Why did I use both survey data and analytics? When determining my research methods, I like to ask myself the following questions:

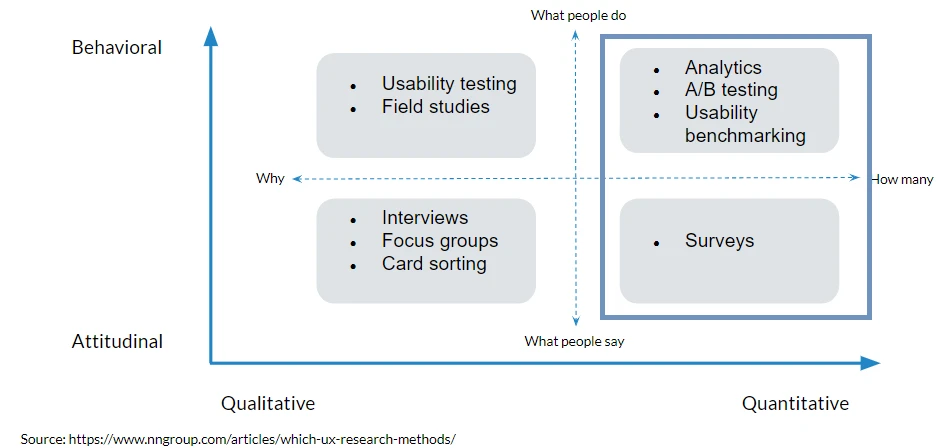

- 1. Am I seeking to understand the 'what' or the 'why'?

- Quantitative methods are ideal for answering “what” questions, as they are great for quantifying and identifying patterns. Conversely, qualitative approaches are better suited for uncovering the “why” behind complex topics that require extensive context and depth. In my case, my research questions leaned towards the quantitative side since the focus was on identifying segments, quantifying their size, and measuring the prevalence of certain business goals and unmet needs.

- 2. Am I interested in learning about attitudes or behaviors?

- My study involved both behavioral and attitudinal variables so I decided to use both surveys and analytics. These quantitative methods were selected because surveys are great at capturing attitudes, while analytics are better suited for studying behaviors.

- 1. Am I seeking to understand the 'what' or the 'why'?

- Participants

-

- Since the tool is designed to enhance the efficiency of maintenance-related tasks for property managers, the primary study criteria are property managers whose job responsibilities include maintenance.

- Analysis

-

- Original plan: My initial analysis plan involved conducting a cluster analysis for users and non-users. Unfortunately, I was unable to obtain a large enough sample size for my user group and was unable to perform cluster analysis on that data.

-

- New plan: I shared this news with my key stakeholders, and we re-evaluated the study objectives together. We decided that, although it wasn't feasible to segment the user data into distinct groups, it was still valuable for the product team to learn about the users as a group. Fortunately, our sample size was sufficient to conduct both descriptive and inferential statistics. With descriptive stats, we could still learn about the prevalence of users' goals and unmet needs. With inferential stats, we could compare and contrast users with non-users to determine how different the two groups are from each other in key areas. By synthesizing this information, we could still assess whether the product is addressing the right problems for our users or not. As for non-users, I proceeded with the cluster analysis as planned since sample size was not an issue.

-

-

- Cluster analysis: I utilized the VarSelLCM package in R to run model-based clustering on my data. I chose this model-based clustering algorithm over traditional distance-based clustering methods like K-means and PAM because a recent benchmark study identified it as one of the best clustering algorithms for mixed data (Preud’homme et al., 2021).

-

KEY FINDINGS

- The results of my cluster analysis showed that there were five distinct non-user segments. By cross-referencing the pain points and goals of each segment with the list of problems our product aimed to address, I was able to determine the segments for which we had good product-market fit and those for which we had poor product-market fit.

- My analysis of the user data yielded valuable insights into their primary business goals and unmet needs. I leveraged this information to assess the product-market fit for the current user group.

- I provided the product team with a list of recommendations based on these findings to help them enhance the product-market fit for both users and non-users.

RESEARCH IMPACTS

- Product: The results helped the product team gain a better understanding of both users and non-users, as well as the extent to which the product meets their needs. Furthermore, my work uncovered new product development opportunities that could enhance the product-market fit for both users and non-users, and it is expected that these will help grow the adoption rate in the long run.

- Marketing: My work made a significant contribution to our marketing efforts. Through my research, I identified a non-user segment that exhibited a strong product-market fit. The marketing team utilized this valuable insight to successfully target and engage this previously untapped segment, ultimately leading to a substantial increase in sales.

MY LEARNINGS

- Always involve stakeholders when tackling research roadblocks. For example, when I had to rework my analysis due to a sample size issue, collaborating with my stakeholders not only helped me resolve the issue more quickly but also kept them invested in the project.

- To maximize the impact of research, remember to share early and often. In this case, by sharing my results early with key stakeholders and incorporating their feedback, I not only strengthened my work but also helped secure more buy-in when I did my larger shareouts.

REFERENCES

Last updated: Oct. 2022